So, you’ve probly heard about the Nvidia Stock Split—the big financial move that got Wall Street buzzing, but also everyday investors talking on social media. It ain’t just another boring technical shift, it’s actually a pretty big deal because Nvidia is sitting right in the middle of the whole artificial intelligence AI wave, plus its chips power massive data center demand.

Let’s break it down in plain words, and see why it matter for both big whales and small retail traders.

What’s a Stock Split Anyways?

A stock split is kinda like taking a pizza and cutting it into more slices. The pizza itself don’t change, but now more people can grab a piece. For companies like Nvidia, splitting shares lowers the share price so it feels easier to buy. Even tho platforms now allow fractional shares, most people still like the idea of holding whole shares, you know?

Nvidia’s 2024 Big Split

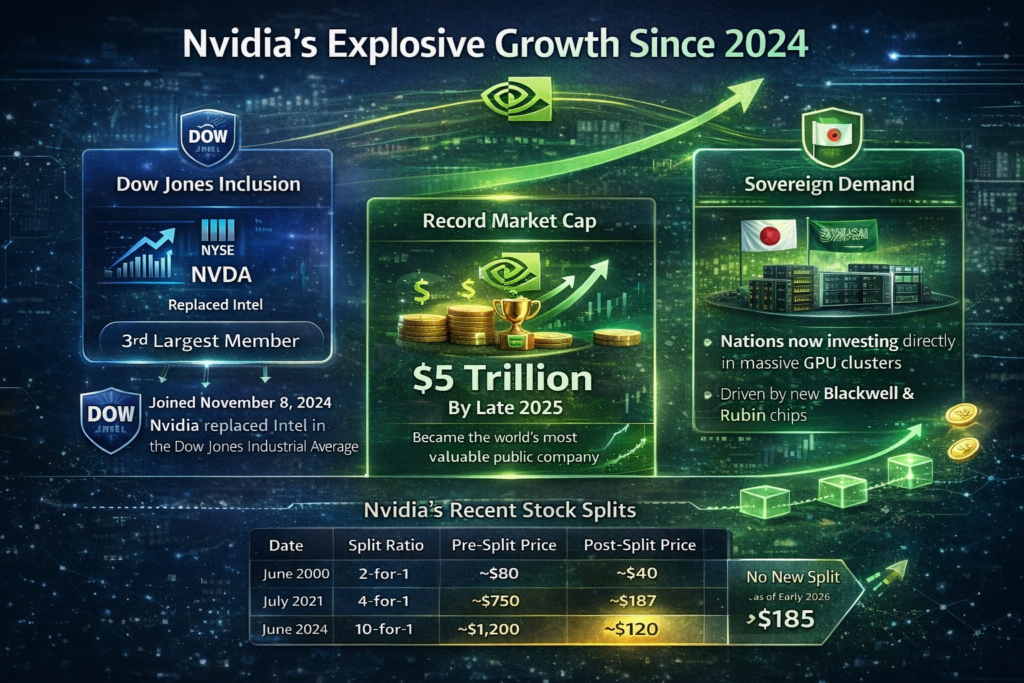

In June 2024, Nvidia announced a massive 10-for-1 stock split. That means if you had 1 share before, you suddenly got 10 after. The catch—your overall investment value didn’t change, just the number of shares in your account.

This wasn’t their first rodeo either. Nvidia has done splits before, like the 4-for-1 split back in 2021. So for long term holders, their positions in Nvidia have multiplied a few times already.

Nvidia Stock Split History (Quick Look)

| Date | Split Ratio | Pre-Split Price | Post-Split Price |

|---|---|---|---|

| June 2000 | 2-for-1 | ~$80 | ~$40 |

| July 2021 | 4-for-1 | ~$750 | ~$187 |

| June 2024 | 10-for-1 | ~$1,200 | ~$120 |

| 2026 Status | No new split | N/A | ~$185 |

This table adds context and shows Nvidia’s pattern—splits usually follow massive price runs, not random timing.

Why The Split Matters

Lowering the stock price from above $1,200 down to a more “friendly” number attracted way more small investors. The move also fueled speculation that Nvidia might get a spot in the Dow Jones Industrial Average, which is price-weighted and prefers stocks under the thousand-dollar mark.

👉 Update: This is no longer speculation.

Nvidia officially joined the Dow Jones Industrial Average on November 8, 2024, replacing Intel. That moment was symbolic—AI and GPUs officially overtook traditional CPU dominance in the market.

Another reason the split mattered is options trading. Before the split, one call option contract represented over $120,000 worth of Nvidia stock. After the split, that dropped to around $12,000, making it way more accessible for retail traders. This opened the floodgates for higher trading volume and, yes, more volatility.

And of course, investor psychology plays a role. A $120 stock feels easier than a $1,200 one, even tho mathematically it’s the same thing.

The Investor Buzz

Retail investors loved it. After the split, NVDA became one of the most held stocks among smaller accounts. Analysts also pointed out the perfect timing—right as Nvidia was riding explosive demand for AI chips, servers, and cloud infrastructure.

Since the split, Nvidia didn’t slow down either.

Market Cap Reality Check (2025–2026)

- By late 2025, Nvidia briefly touched a $5 trillion market cap, becoming the largest public company in the world.

- As of early 2026, the stock trades roughly in the $180–$190 range (post-split).

- Nvidia now constantly trades places with Apple and Microsoft for the #1 spot globally.

This growth is driven by newer chip architectures like Blackwell and Rubin, not just the H100 chips that dominated headlines in 2024.

For a deeper breakdown of how splits work, check out Investopedia’s explainer on stock splits.

AI Growth, Sovereign Demand, and Real Risks

Another big 2026 trend pushing Nvidia is Sovereign AI—countries buying massive GPU clusters directly for national infrastructure, defense, and research. Nations like Japan and Saudi Arabia are investing heavily here, and Nvidia is the main supplier.

But let’s be real—there are risks.

Some investors worry the stock split and retail hype fed into an AI bubble. That’s why smart investors don’t just stare at the price. They watch Nvidia’s P/E ratio, earnings growth, and data center margins instead.

Splits don’t change fundamentals. Earnings do.

Quick FAQ

Not really. It only lowers the per-share price. The company’s total value stays the same.

Unlikely. Nvidia historically splits when prices approach $1,000. At ~$185, another split would require a huge run first.

As of early 2026, it’s a three-way tug of war between Nvidia, Apple, and Microsoft—changing quarter by quarter.

Nope. Dividends adjust per share, but your total payout stays the same.

Final Word

The Nvidia Stock Split was more about accessibility, psychology, and market mechanics than real math magic. It helped pull in retail investors, unlocked options trading activity, and smoothed Nvidia’s entry into the Dow Jones.

But what really drives the stock long term isn’t the split—it’s Nvidia’s chokehold on artificial intelligence AI infrastructure, data centers, and sovereign-level demand.

Splits can make stocks look cheaper.

Fundamentals are what make them valuable.

Visit our website: Swifttech3